21+ Illinois Pay Calculator

Web The Pay Calculator is an Excel spreadsheet that is used to calculate partial month pay and pay adjustments for Academic employees. Well do the math for youall you need.

/fit-in/1200x630/1665740575/enjoy-illinois-300.jpg.jpeg)

Enjoy Illinois 300 Predictions Odds Best Bets Cup Series

That makes it relatively easy to predict the income tax you will.

. Determine your filing status Step 2. The Illinois Paycheck Calculator uses. Web The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

When the file opens save a copy by. Web Illinois Paycheck Calculator Frequently Asked Questions How do I use the Illinois paycheck calculator. Just enter the wages tax.

Net income Adjustments Adjusted gross income Step 3. For example if an employee earns 1500 per week the. Web Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. All you have to do is enter wage and W-4. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois. Web The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Simply enter their federal and state W-4.

Simply follow the pre-filled calculator for Illinois and identify your. States have no income tax. Web The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes.

Web How do I figure out how much my paycheck will be. Web The Illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. Web Illinois Salary Paycheck Calculator Change state Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

Nine states dont tax employees and. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

/cdn.vox-cdn.com/uploads/chorus_image/image/71430167/usa_today_19094382.0.jpg)

So This Is What A Big Game Feels Like The Champaign Room

Illinois Hourly Paycheck Calculator Gusto

Horse Racing Calculator And Convertor

Betmgm Illinois Bonus Code For 1 000 Risk Free

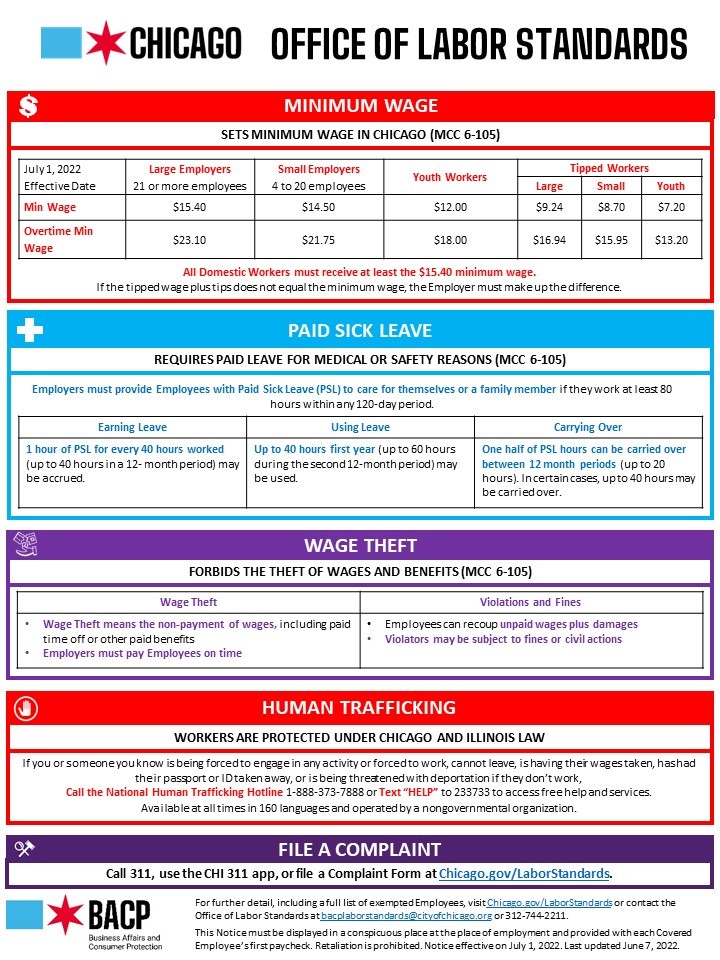

City Of Chicago Minimum Wage

Which Upstart Bookmaker Gets A Boost From Illinois Sports Betting Mess

Illinois Hourly Paycheck Calculator Gusto

Michigan Vs Illinois Prediction Picks Start Time November 19 2022 Betsperts

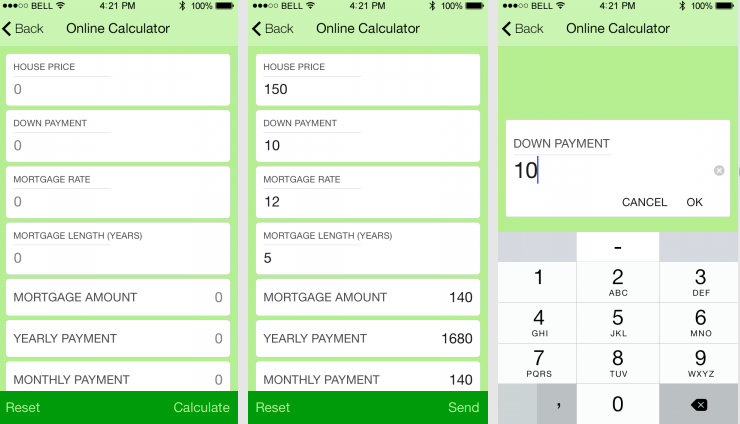

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Jul 27 Byob Bingo At Prairie Bluff Preserve Joliet Il Patch

Illinois Vs Purdue Prediction Picks Start Time November 2022 Betsperts

/cdn.vox-cdn.com/uploads/chorus_image/image/71252250/1389366535.0.jpg)

Hawkeye Football Projecting Iowa S October Matchups In 2022 Black Heart Gold Pants

Illinois Vs Northwestern Prediction Picks Start Time November 26 2022 Betsperts

/fit-in/1200x630/1665751942/google-pay.jpg.jpeg)

Sportsbooks That Take Google Pay

Illinois Income Tax Calculator Smartasset

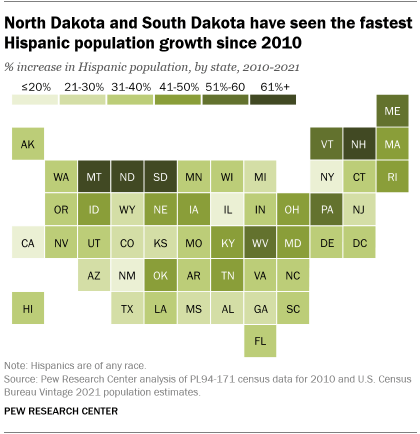

Facts About U S Latinos For Hispanic Heritage Month Pew Research Center

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b